By Jay Shareef and Chris Rhoads

If you’re a federal government employee, you’re used to enjoying many benefits, and one big advantage is the potential for long-term financial success. While some private-sector employees dream of retiring after 30 years, it’s often not a reality. However, even though you’re allowed to retire after 30 years in your federal job, it’s not always easy to make it happen. Without careful planning and management of your money, retirement might be as difficult to reach as it is for the general public.

At WealthFlow Financial, we’ve seen the unfortunate consequences for people who didn’t plan properly and ended up going back to work after retiring. It’s our goal to help you avoid that fate! To that end, let’s chat about what you can do as a federal employee to retire on schedule.

Know Your Retirement Age

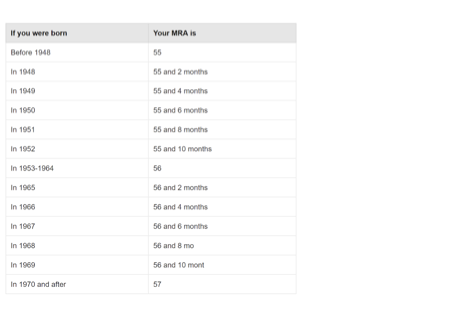

One of the keys to retiring on time is maximizing your retirement benefits. When you retire and how long you have been in service will greatly affect the benefits you receive. If you retire before you have reached your minimum retirement age (MRA) or before you have completed enough service, you will not be able to maximize your benefits. The following chart shows your minimum retirement age

To receive full benefits, you must either have 30 years of service and reach your MRA, or have 20 years of service and be age 60 or older. If you have between 10-30 years of service, you are allowed to retire at your MRA, but your benefits will be reduced by 5% a year for each year you are under age 62. For example, if you retire at age 56 with 19 years of service, your benefit will be reduced by 30% (5% for each of 6 years). However, if you work 4 more years and retire at age 60 with 23 years of service, you will receive the full benefit.

The amount of benefit you receive will affect your ability to retire successfully (i.e., having enough money to live on without going back to work). It is important to strategically balance your years of service and retirement age in order to receive a high enough benefit to support you during retirement. Sometimes simply working one or two more years can make a big difference in your benefit amount.

Keep Your High-Paying Job a Little Longer

Another factor in your benefit calculation is your salary. Under FERS, your pension benefit is calculated as:

(average of 3 highest years’ salary) X (years of service) X (pension multiplier)* = (annual pension benefit)

*The pension multiplier depends on your years of service and age at retirement, as discussed above.

If your salary significantly increases shortly before retirement, working a couple more years may be well worth it. Let’s say you plan to retire at age 60 with 30 years of service. One year prior, you go from earning $100,000 as you did for the previous 2 years to $120,000. If you retire as planned, your pension benefit will be:

$106,667 X 30 years X 1.1% = $35,200

If you decide to stay in that higher-paying job for two more years, your pension benefit will be:

$120,000 X 32 years X 1.1% = $42,240

Staying in the higher-paying job for at least three years to increase your benefit calculation can make a big difference in retirement. In our example, it is a $7,040 difference per year. Over a 20-year retirement, that comes out to $140,800.

Take Advantage of Your TSP Match

In addition to your FERS pension, as a federal employee, you have access to the Thrift Savings Plan (TSP). Instead of getting a promised pension amount, what you get out of it is a combination of what you put in and how you invest it, much like the popular private-sector 401(k) plan. It is your choice whether or not to contribute to the TSP and how much you put in it.

To build up the most funds for retirement, you need to contribute up to your agency’s match. Receiving a matching contribution from the government is essentially an immediate 100% gain on your money. Your agency matches your contributions up to 5% of base pay, so you should contribute at least that much. Contributing any less is leaving free money on the table, money that will fund your retirement.

Optimize Your TSP Growth Potential

On top of getting your agency match, you want to make sure your TSP funds are invested wisely. Where you put your money over a 30-year career can make a huge difference in your account balance when it comes time to retire, and it can greatly affect your ability to do so. It may be tempting to keep your money protected from the volatility of the stock market, but that also robs you of the opportunity for your money to grow along with the stock market. Without that growth, you may not have enough funds to retire on time.

The ideal investments for your TSP will vary based on factors like your age, objectives, and risk tolerance. Since there’s no universal solution, seeking guidance from a seasoned financial advisor is recommended. A financial professional can assist in constructing a diversified TSP portfolio tailored to your needs and strategize a comprehensive retirement plan so that you retire on schedule.

At WealthFlow Financial, we collaborate closely with clients to develop retirement plans that instill confidence and clarity while safeguarding their future. Through personalized retirement planning strategies for federal employees, we empower you to navigate the complexities of the financial process. If you’re looking for a fiduciary financial advisor who puts your interests first, reach out to us at (301) 798-5250 or schedule a phone call now.

About Jay

Jay Shareef is vice president, financial advisor, federal benefits consultant, and co-founder at WealthFlow Financial. As a U.S. Army veteran, Jay is passionate about helping federal employees create a bulletproof plan for retirement and navigate the often confusing and complicated federal benefits landscape. He spends his days educating and providing clients with unbiased insurance benefits and retirement strategies to help his clients create guaranteed income for life. As a problem-solver and trustworthy resource, Jay always puts his clients and their needs first so they can find financial peace of mind. To learn more about Jay, connect with him on LinkedIn.

About Chris

Chris Rhoads is a co-founder and vice president of WealthFlow Financial. As a registered investment advisor and independent financial professional, Chris is committed to helping his clients in retirement and he takes a holistic approach to financial planning that includes insurance and risk management, investments and wealth management, retirement income planning, and estate and tax planning. Chris has been married to his wife, Tia, since 2009 and they live in Frederick, MD, together with their two young daughters. In his free time, Chris enjoys traveling, watching sports, and being active in causes about which he cares passionately. To learn more about Chris, connect with him on LinkedIn.